by Larson Gross | Jun 12, 2025

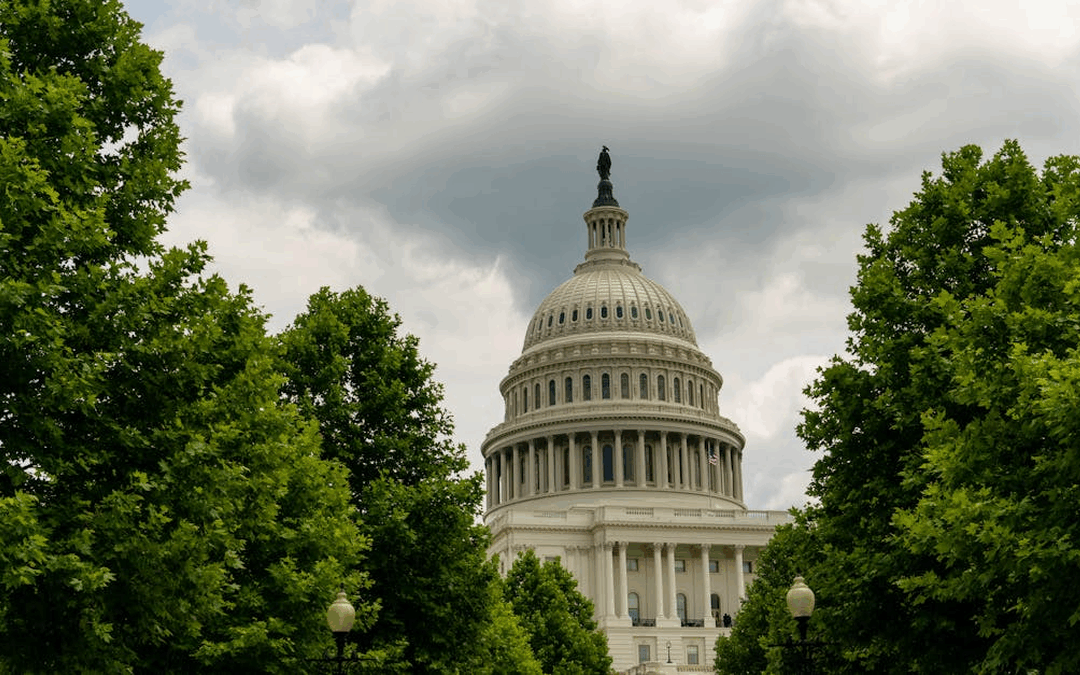

INSIGHTS House Reconciliation Bill: AICPA’s Concerns Over Some Proposals by Larson Gross ARTICLE | June 13, 2025 The House recently passed a sweeping reconciliation package informally known as the One Big Beautiful Bill Act (OBBBA, H.R. 1). Within its many...

by RSM US LLP | Jun 10, 2025

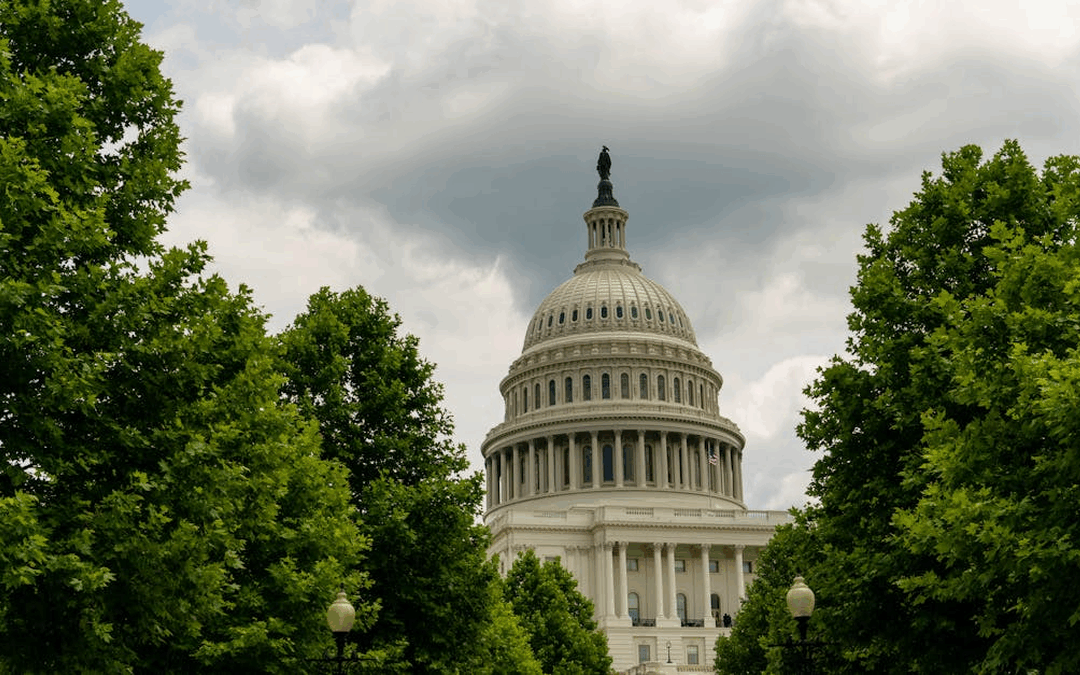

INSIGHTS Washington State Enacts Broad Tax Increases by RSM US LLP ARTICLE | June 02, 2025Executive summaryOn May 20, 2025, Washington Gov. Bob Ferguson signed multiple tax bills into law as part of the biennial budget passed by the state legislature on April 28,...

by RSM US LLP | Jun 2, 2025

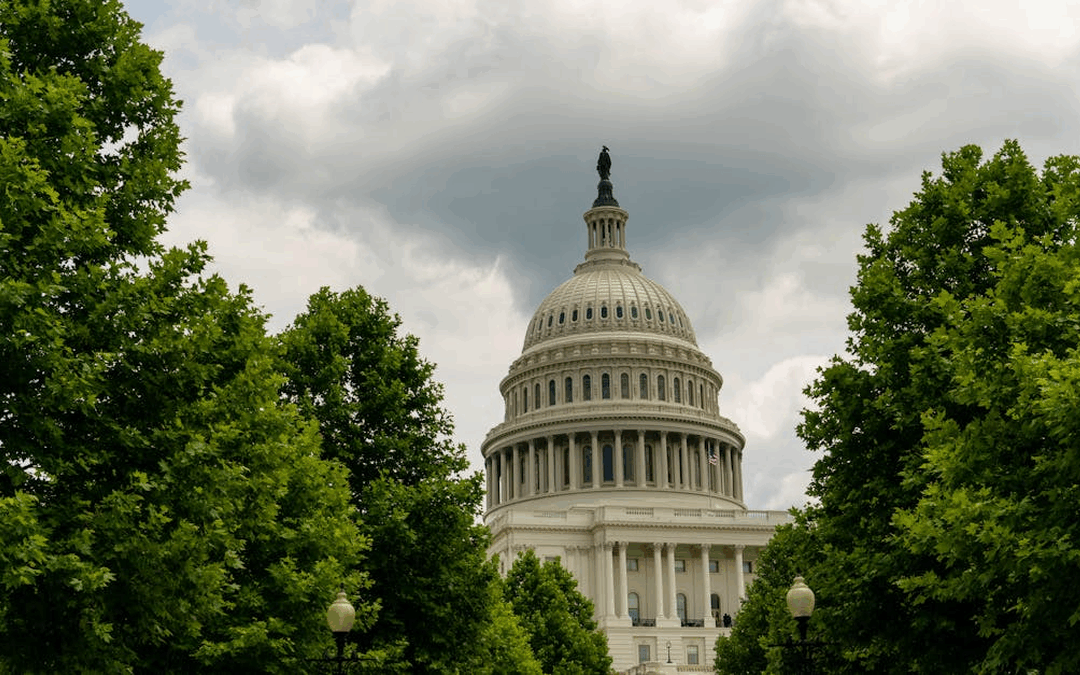

INSIGHTS No tax on tips and overtime: What employers should know by RSM US LLP ARTICLE | June 02, 2025Executive summaryProvisions titled “No tax on tips” and “No tax on overtime” are part of the One Big Beautiful Bill Act, which the U.S. House of Representatives...

by RSM US LLP | Apr 14, 2025

INSIGHTS Estate Planning Q&A: Charitable split interest trusts explained by RSM US LLP ARTICLE | April 14, 2025For charitably inclined individuals, a split interest trust, such as a charitable remainder trust (CRT) or charitable lead trust (CLT) can be a...

by RSM US LLP | Apr 11, 2025

INSIGHTS Estate Planning Q&A: Donor Advised Funds Explained by RSM US LLP ARTICLE | April 11, 2025A donor advised fund (DAF) can be a valuable tool for charitable and tax planning. When strategically utilized, contributions to a DAF offer significant...

Recent Comments