by Larson Gross | Jan 25, 2024

INSIGHTS Tax advantages of qualified charitable distributions by Chad VanDyken, CPA, CFP® ARTICLE | January 25, 2024 An individual retirement account (IRA) is a powerful retirement saving tool. But once you reach age 73, you must begin taking distributions,...

by Larson Gross | Jan 23, 2024

INSIGHTS Navigating the New DOL Guidance on Worker Classification by Colleen Malmassari, SHRM-CP, PHR ARTICLE | January 23, 2024 The U.S. Department of Labor (DOL) has issued a new rule clarifying the distinction between employees and independent contractors under...

by RSM US LLP | Jan 18, 2024

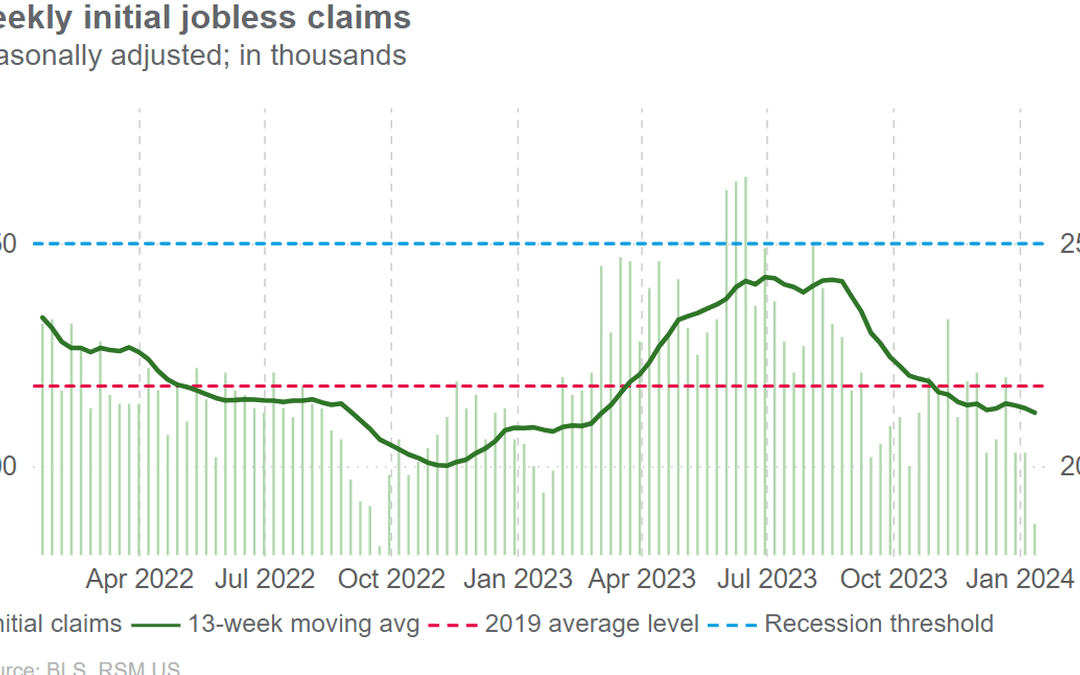

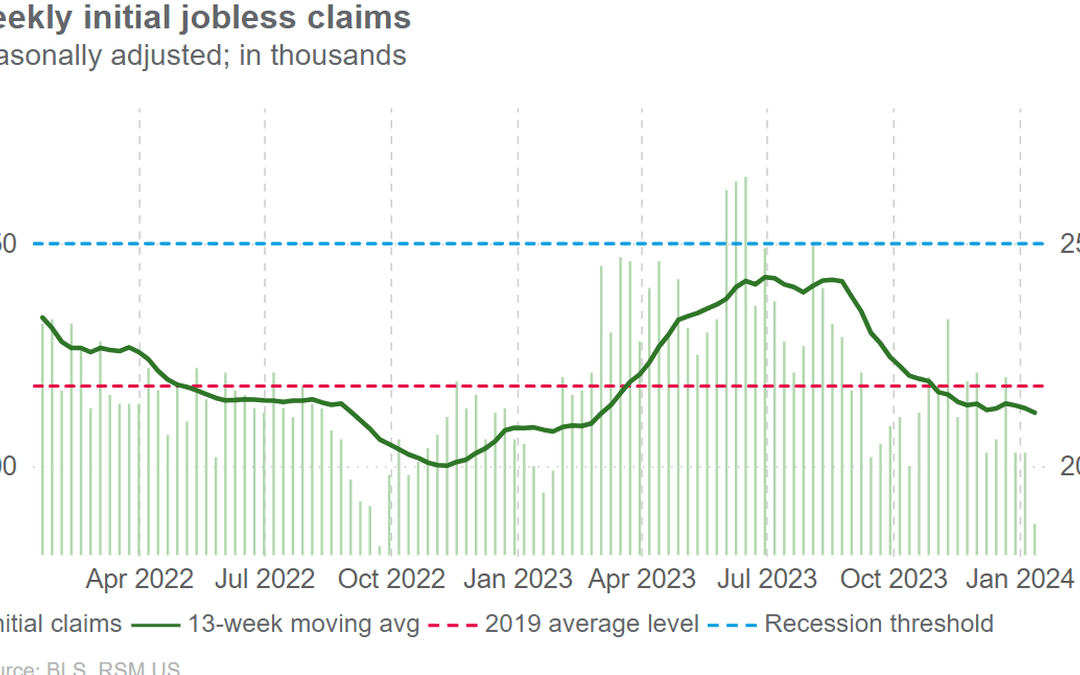

INSIGHTS Initial jobless claims and housing starts post upside surprises by RSM US LLP REAL ECONOMY BLOG | January 18, 2024Filings for jobless benefits fell last week to their lowest level in 16 months, a testament for how resilient the labor market continues to...

by Larson Gross | Jan 17, 2024

INSIGHTS Video Resources by Larson Gross Download our Whitepaper Click below to view our in-depth whitepaper. Let’s Talk! You can call us at (800) 447-0177 or fill out the form below and we’ll contact you to discuss your specific situation. type="tel"...

by RSM US LLP | Dec 21, 2023

INSIGHTS Key trends in compensation planning by RSM US LLP ARTICLE | December 21, 2023Executive summary:As organizations gear up for the challenges and opportunities of the next several years, strategic compensation planning takes center stage. The evolving...

Recent Comments