INSIGHTS

INSIGHTS

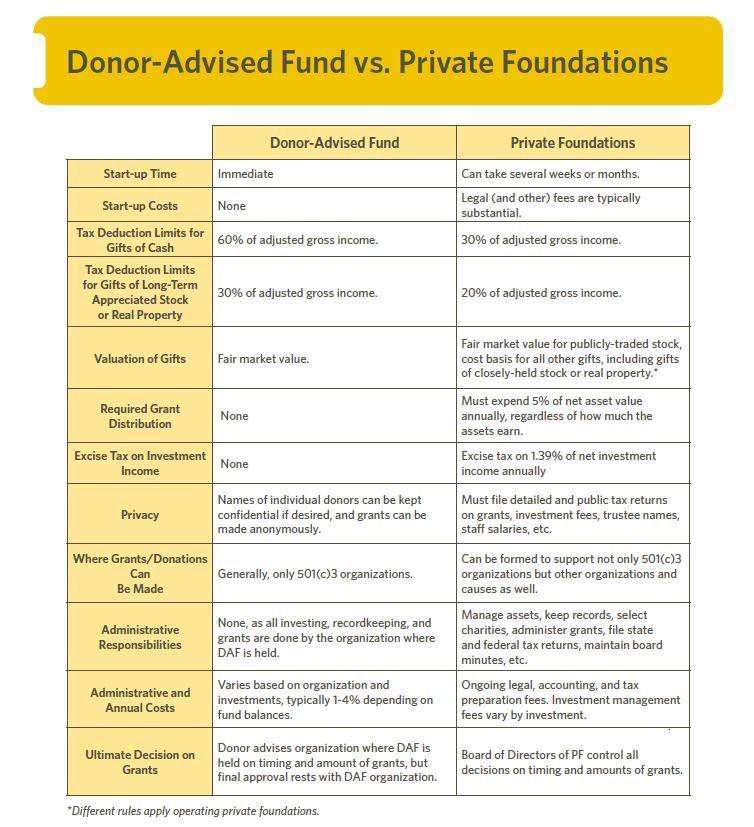

Donor-Advised Fund vs. Private Foundation

by Demi Luna

What is a Donor-Advised Fund?

A donor-advised fund (DAF) is a charitable giving vehicle owned and controlled by a sponsoring organization. This fund was created to manage charitable donations on behalf of individuals, families and organizations. Ultimately, assets are donated into a DAF exclusively to invest, grow and give to charities. Your contribution is tax-deductible in the year made and the assets in the DAF grow tax-free. When it's time to donate, the donor recommends which charity they would like to give to.

How Could a DAF Benefit You?

- Because the standard deduction has almost doubled from previous years, combined with the capping of the state and local tax deduction and elimination of most miscellaneous itemized deductions, most taxpayers are no longer itemizing. By using a DAF, taxpayers can “bunch” their charitable contributions usually made in multiple years into one year to exceed the standard deduction and can then schedule the donations to be paid to the charity over multiple years.

- TCJA suspended limitations on itemized deductions and increased the limitation on contributions from 50% to 60% through 2025 meaning that high income donors who were normally limited on itemized deductions can now donate more and still receive a full tax deduction for their contributions.

- Costs very little to operate, avoids the responsibilities of other giving vehicles and makes for quick donating near year-end for tax planning purposes.

- Successors can continue to recommend donations even after original donor is deceased.

A private foundation is an independent legal entity set up for charitable purposes. The funding of the private foundation comes from an individual, estate, trust or corporation. The donor receives a deduction for the contributions in the year made. The foundation then holds the assets until the donor is ready to disburse funds; however, if the entity is a nonoperating private foundation, it is required to distribute 5% of its net asset value annually. The donor determines the foundations mission, who to include on the foundation board, where the funds are invested and how the funds are given away.

How Could a Private Foundation Benefit You?

- Creating a private foundation is a popular option as it allows donors to deduct the fair market value of certain appreciated stock.

- An individual planning to leave large amounts of assets to charity upon death may prefer a private foundation as it provides control, long-term charitable giving goals and could be a living family heirloom passed from one generation to the next.

- Beneficial and desired by high wealth individuals to establish when donor’s taxable income is high in one year or on a short-term basis to give the donor time to decide on how to use funds

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.

Demi Luna

Senior Associate

Demi Luna joined Larson Gross in 2016 and specializes in tax preparation and planning for individuals and families in the U.S. and Canada.