INSIGHTS

INSIGHTS

Strategies for streamlining the grant management process

by RSM US LLP

ARTICLE | August 15, 2021

Grants are the lifeblood of many nonprofit organizations, providing the funding requirements necessary for an organization to deliver on its mission. Since grants are a crucial component of an organization, it is equally as critical to have a strong grant management framework to ensure that grant funds are spent in accordance with the commitments made to each funder.

Unfortunately, grant management is often an afterthought or additional process that gets imposed upon, rather than integrated into, other responsibilities that come with running a nonprofit organization. Additionally, grant management can touch all areas of the organization. Yet often there is no unifying group overseeing this crucial business function. This can lead to frustrating and inefficient processes that take away time spent on activities directly related to the organizational mission. In some cases, inefficient and manual processes can lead to noncompliance with funders, employee turnover and inaccurate data.

If not handled correctly, grant management can only get more complicated and time-consuming as an organization grows.

The grant management framework

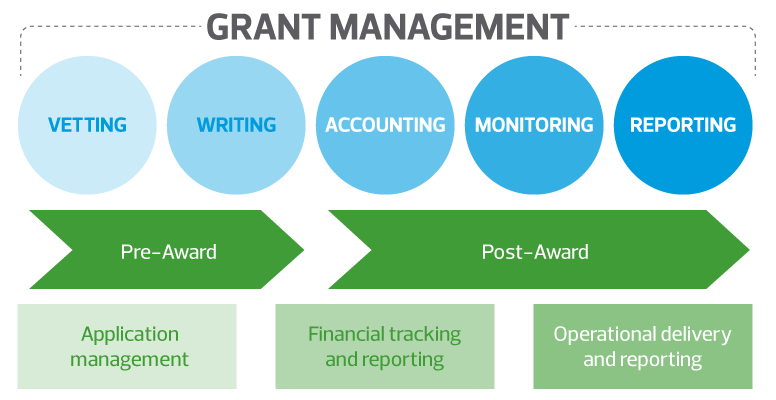

Just as grant management involves every department throughout an organization in one way or another, the framework itself is comprehensive?from the pre-award period of identifying grants and managing the application process through the post-award stage of delivery, tracking and reporting on progress.

To streamline and improve grant management, it helps to break it down into manageable core segments:

- People: the organizational structure and staffing as well as the framework and structure for managing the process

- Processes: operational procedures necessary to meet both delivery and reporting requirements

- Technology:the systems that encompass a broad range of functionality to serve as the foundation for the grant management process

People: Dedicated to the process

As a rule, nonprofit organizations are run with lean staffs. Effective grant management requires employees who are dedicated specifically to grants and not overly burdened with additional responsibilities. While staffing will vary by the size of an organization and volume of grants, personnel needs may include:

- Grant accountant(s) to focus on transactional requirements and compliance

- Grant manager(s) to oversee and administer the portfolio of grants

- Grant writer to focus on proposal writing and reporting to streamline the writing process, reduce the administrative burden on the subject matter experts and maintain standardized content

- Director to manage the grant portfolio and staff as grant volume and the grant management team grows

For very large organizations, these roles are often part of a grant management office, a dedicated department that focuses on grant strategy, operations and compliance. Smaller organizations can optimize their grant processes without a dedicated department by ensuring that roles and responsibilities are clearly outlined and defined across the life cycle of a grant.

Process: From confusion to efficiency

Strong grant management processes give organizations more time to focus on their missions. In order to understand grant processes, it is helpful to organize processes into three core process areas:

Administrative processes center on the management and administration of the entire grants portfolio. Primary components include management of key contacts, reporting dates and coordination of cross-functional resources throughout the grant life cycle.

Additionally, strong administrative processes enable organizations to leverage standardized content when applying for new grants and provide a framework for delivering and reporting on grants both to funders and for internal management reporting.

Financial processes should be designed to simplify compliance. Funders have stringent requirements to ensure money is spent according to the agreed-upon commitments between the funder and the organization.

A lack of policies and procedures is one of the most frequently cited areas of noncompliance. Taking the time to put in solid policies and procedures goes a long way toward making grant management more efficient and less time-consuming. A lack of documentation, another commonly found application complaint, indicates that an organization is not taking grant management seriously enough, which could ultimately lead to a funding shortfall. In addition, the chart of accounts is not the appropriate place to track grants. Often organizations utilize the general ledger to track grants; this can lead to exponential growth in the chart, making it difficult to manage and report on financial data.

For financial processes, it is about getting data into the system. This typically breaks down into three categories: expenses (including purchasing and expense reimbursement); labor (payroll allocation and time tracking) and subawardee expenses. To pull all of this data together, however, requires the cooperation of departments across an organization, making the need for clearly defined data-gathering procedures critical to the success of grant reporting compliance.

Operational processes include delivering the programs and measuring their effectiveness. In addition to reporting back to funders on key program metrics, it is equally as important to leverage data on outcomes and successes in order to build the brand of the organization. Being able to demonstrate the positive impact and success of a program becomes a virtuous circle for an organization: the greater the impact, the better the chances of earning additional grant funding.

By designing and implementing strong processes across these three categories, organizations will benefit from increased efficiency as well as improved intelligence about current and future grants.

Technology: Building on a strong foundation

Strong back-office technology will reduce manual paperwork, save time and increase accuracy. Systems for accounting, content management, business intelligence, payroll and time tracking all play a role.

In the pre-award phase, customer relationship management systems can help track applications and manage the process throughout its life cycle. They are flexible enough to add custom fields in order to, among other things, track different types of grants in a portfolio as well as store templates, biographies and other relevant information.

In the post-award phase, accounting systems may include separate, third-party grant subledgers or modules specifically made for grant management to make reporting easier. These may be preferred over using charter accounts for grant management and can be relatively inexpensive. Which module or third-party ledger works best will depend on the individual organization's needs. But it is important to establish the processes first before engaging technology.

Getting started

As any driver knows, road maps are critical when traveling to a new destination. Creating a grant road map is important because it helps an organization understand how to reach its goals, how long it will take and how much it will cost.

First, it helps to know the starting point. A strong foundation for grant management relies on grant accounting systems and resources, program delivery metrics, and a core staff for grants and program delivery.

Once the foundation is in place, the focus can evolve into making the process more efficient. This includes making access to administrative information easy and readily available. It also means developing strategic comparisons of the impact that various grants have on time and resources spent for application and compliance in relation to the actual amount that the grants would award.

The road map timeline provides a high-level overview of the process, time and cost requirements it will take to execute a recommended course of action.

Finding the budget to implement recommendations can be difficult and could require a different perspective on where money is currently being spent. Investing in technology, for example, may mean adjusting the percentage of the IT budget currently dedicated to operational expenses, or "keeping the lights on", to expand the percentage spent on implementing strategic business solutions such as new applications or IT infrastructure.

Clearly, grant management is extremely important to nonprofit organizations. Developing a streamlined grant life cycle through people, processes and technology will allow an organization to spend more time delivering on its mission as well as positioning it to win future grants.

Originally published February 17, 2015, updated and reviewed on August 16, 2021.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Bill Kracunas, Kim Susko and originally appeared on Aug 15, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/nonprofit/strategies-for-streamlining-the-grant-management-process.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Larson Gross PLLC is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Larson Gross PLLC can assist you, please call (800) 447-0177.