INSIGHTS

INSIGHTS

Research & Experimentation Tax Credit

by Meaghan E. Greydanus, CPA

ARTICLE | January 31, 2025

Research & Experimentation (R&E) tax credit (also known as Research & Development tax credit) results in permanent tax savings when a taxpayer conducts qualified activities towards design, development, or improvements that occur in the United States.

Common Types of Eligible Businesses

- Agricultural

- Manufacturing

- Architectural and engineering firms

- Energy and utilities

- Computer software

- Pharmaceuticals

- Telecommunications

Examples of Qualified Activities

Many businesses assume they aren’t eligible because they are too small or aren’t developing an industry-changing invention. While there is a break-even point where the cost of documentation reduces the benefit of the credit, we can help determine if your business is a good candidate for the R&E credit.

- Develop new or improved products, prototypes, models, processes, or formulas.

- Develop or apply for patents.

- Develop new or improved manufacturing processes.

- Increase automation or streamline internal processes.

- Develop production equipment.

- Develop new or improved software applications.

Does Your Activity Meet the Four-Part Test?

To qualify, the activity must pass the four-part test:

1. Permitted Purposes

The activity must be intended to develop or improve a business component’s (product, manufacturing process or software):

- Functionality

- Reliability

- Performance

- Quality

2. Technological in Nature

The activity must fundamentally rely on principles of:

- Physical science

- Biological science

- Computer science

- Engineering

3. Elimination of Uncertainty

The activity must be intended to discover information concerning the capability or method for developing or improving a product or process, or the appropriateness of the product design.

4. Process of Experimentation

Substantially all the activities must be elements of a process of experimentation involving:

- Developing one ore more hypotheses (design alternatives or prototyping).

- Designing and conducting experiments to test and analyze those hypotheses.

- Refining or discarding those hypotheses to design the business component.

- Modeling, simulation, trial and error testing.

Non-Qualifying Activities

The following types of activities don’t qualify:

- Research done outside the United States.

- Research in the social sciences, arts or humanities.

- Ordinary testing or inspection of materials or products for quality control.

- Market and consumer research.

- Advertising or promotion expenses.

- Management studies and efficiency surveys.

- Research funded by another person, or any governmental entity, by means of a grant or contract.

Costs Included in Credit Calculation

The following costs are eligible to be used to calculate the R&E credit if they are incurred in the United States:

- Salaries and Wages: direct, supervisory and support wages based on percent of time spent on R&E activities.

- Supply Costs: supplies used or consumed in the research process (not applicable to assets with depreciable lives).

- Computer Rental or Lease: certain time-sharing costs for computer use in qualified research.

- Contractor Costs: 65% of expenses paid to outside contractors who conduct research on your behalf.

Examples of Documentation

Documenting your R&E activities may be accomplished in a variety of ways. Including, but not limited to:

- Documentation of experiments.

- Hand sketches, design concept drawings, CAD designs showing the evolution of product designs.

- Data related to the research activity such as predicted results vs. actual results achieved.

- Submissions to management, review committees, or other similar groups regarding research projects, activities, expenditures, and the credit.

Do not let the documentation process overwhelm you. We can help you assess your R&E activities and determine the most effective documentation process. Note that the IRS is considering making changes to Form 6765, Credit for Increasing Research Activities, which would be effective beginning with the 2024 tax year. These proposed changes will necessarily represent an expansion of the information taxpayers will be required to report related to the research credit.

R&E Tax Credit Savings

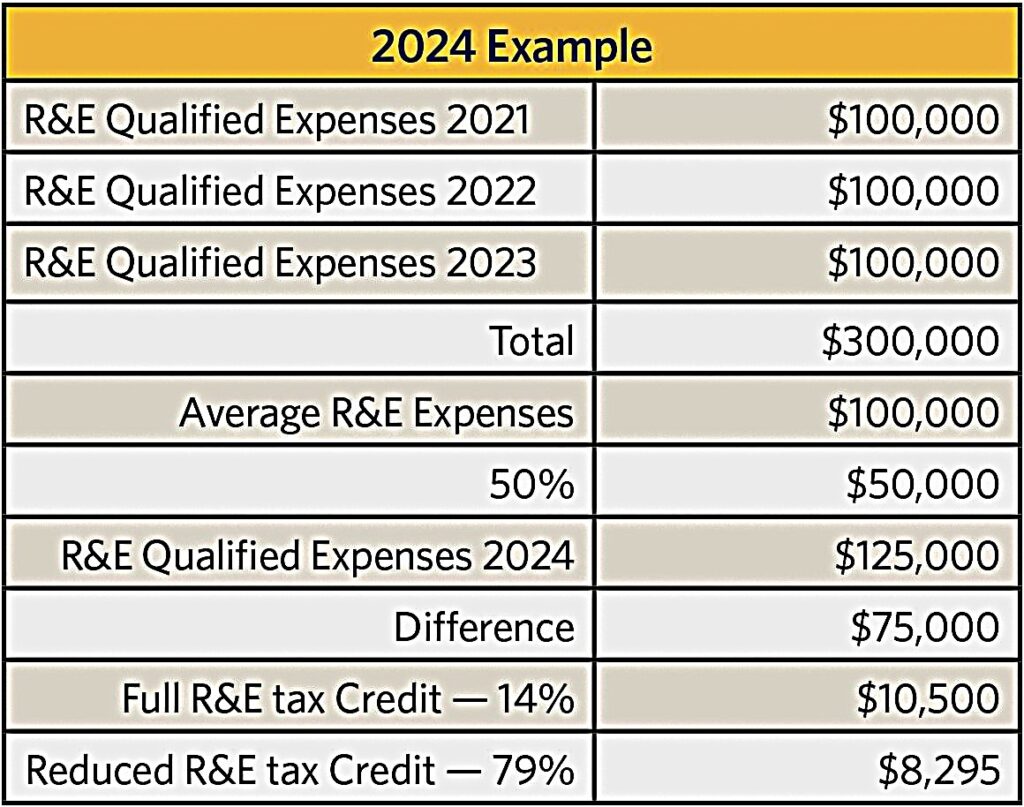

There are two methods used to calculate the R&E credit. One requires an extensive look back at past years’ tax returns and R&E activities; the other is less complicated and focuses only on the previous three years. With either method, the resulting credit is included in taxable income at its full amount but can be excluded under certain circumstances.

The amount of R&E credit you can claim also may be limited to the Alternative Minimum Tax. However, the R&E tax credit can be carried forward up to 20 years.

Many start-up companies or companies experiencing losses do not think they are a good candidate for the credit, but, those loss years can be some of your most experimental years. As an alternative, you can offset the employer’s portion of social security tax by up to $250,000 per quarter or $500,000 per year.

Our careful review of all these scenarios determines which computation method will produce the best outcome and whether the savings generated by the credit will outweigh the cost of compiling the documentation.

R&E Tax Credit Example

Common Misconceptions

Many businesses assume they aren’t eligible because they are too small or aren’t developing an industry-changing invention. However, this often isn’t the case. While there is a break-even point where the cost of documentation eats up the credit, we can help determine if your business is a good candidate for the R&E credit.