INSIGHTS

INSIGHTS

Opportunity Zones

by Leslie Hill, CPA

The 2017 Tax Cuts and Jobs Act created a new initiative, referred to as Opportunity Zones, to motivate private investment in underdeveloped and economically distressed areas across the United States. This program incentivizes individuals to invest by allowing for the deferral of capital gains, reducing tax obligations on a portion of those gains, and allowing Qualified Opportunity Zone (QOZ) investments to grow tax free if certain requirements are met. If you are facing a significant tax liability because of capital gains, investing in Opportunity Zones may be an advantageous tax planning strategy for you.

Potential Federal Income Tax Benefits

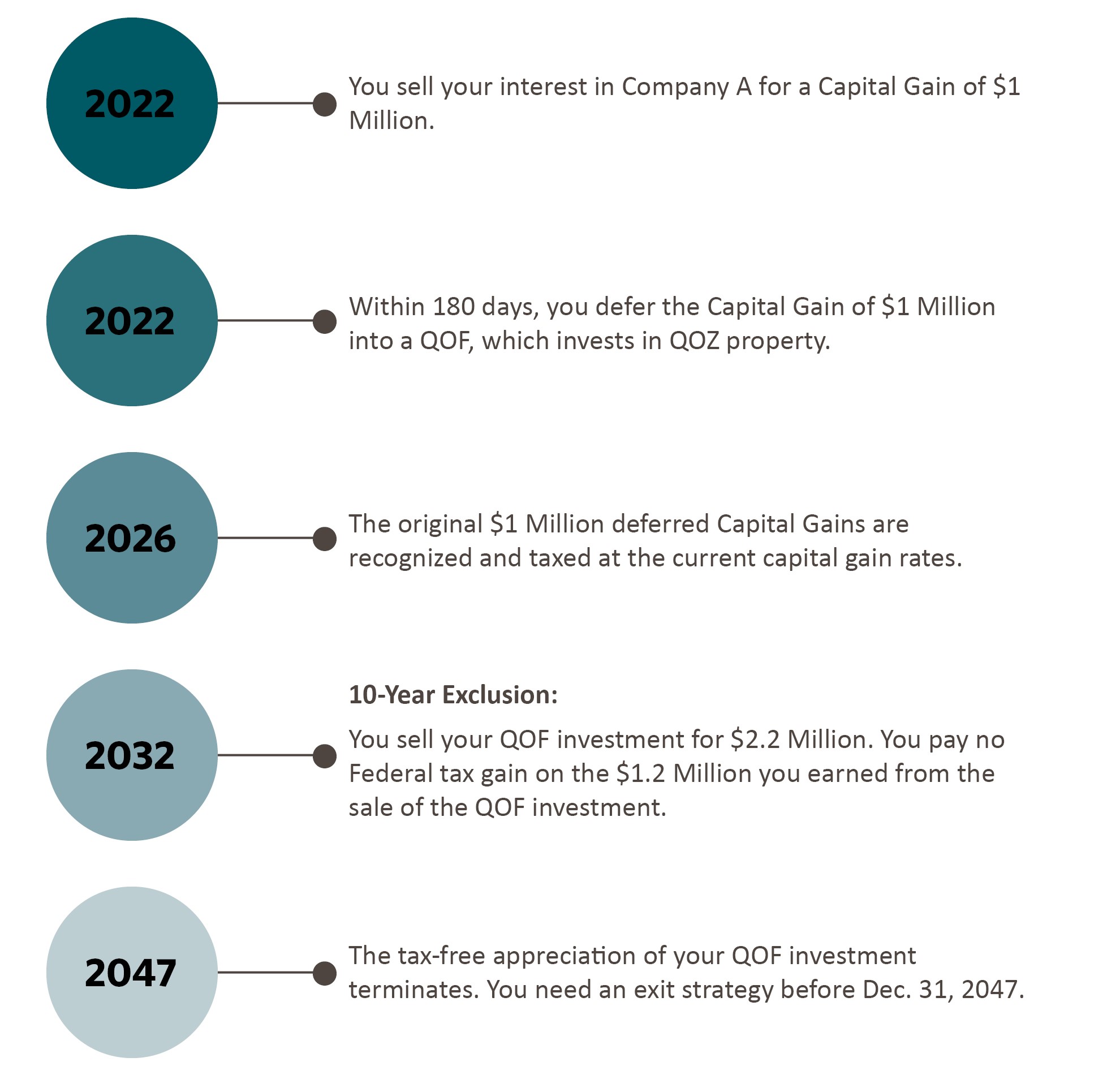

If you have eligible capital gains, you may defer them by reinvesting the gain amount into a Qualified Opportunity Fund (QOF) within 180 days of your sale or exchange. The Opportunity Zone program offers three key federal income tax benefits, including deferral of original gain, reduction of original gain, and QOZ investment appreciation exclusion that can be recognized over the investment period:

- Deferral of gain benefit: The capital gains you invest into a QOF are excluded from your income until the date you sell the investment or Dec. 31, 2026 – whichever is earlier.

- Appreciation exclusion benefit: If you hold your QOF investment for 10 or more years, no tax is recognized on the appreciated portion of the investment when sold or exchanged.

A previously available tax benefit offered by this program was the reduction of original gains. If you held your QOF investment for five years, you could eliminate 10% of the capital gains you invested from tax, with an additional 5% if held for seven years. This benefit is no longer available, as the capital gain needed to be invested by December 31, 2021.

While the deferral and reduction of gain benefits disappear over time, the appreciation exclusion benefit is available for investments made through 2026 and held for at least 10 years, through 2047.

Navigating QOF Requirements

A QOF is an investment vehicle which is organized as a partnership or corporation for the purpose of investing in Qualified Opportunity Zone Property. Generally, a QOF must invest and hold at least 90% of its assets in Qualified Opportunity Zone Property used in a trade or business.

Operating a Business in a QOZ

While the Opportunity Zone program is primarily focused on providing tax breaks for investors, various types of developing companies may be able to capitalize on the program as well.

As taxpayers begin to consider investing their capital gains into QOFs, they’ll be searching for Qualified Businesses in which they can invest in. To be considered a QOZ Business, a business must meet several criteria, including income and property location tests.

Investing in QOZ Real Estate

QOFs can directly invest in residential or commercial real estate that is used in a trade or business within the QOZ. Similar to operating businesses, there are several criteria that must be met in order to qualify.

Potential Drawbacks

As with any investment, there are potential drawbacks that should be considered. If you’re deciding on whether to invest in QOFs or not, consider the following potential snags before making a final decision:

- You’ll incur new associated fees with your investment, including additional compliance and tax reporting

- QOF investments are generally intended to have life cycles of a decade or

- There could potentially be a decline in your investment or loss of your investment that outweighs the tax

- Skill of independent QOF managers must be considered.

- Potential increases in capital gain tax rates in 2026 compared to currently low

- Liquidity issues to pay deferred gain taxes on illiquid investments.

Considering Your Specific Scenario

While this new provision could bring advantages to your tax situation, many questions come into play as you evaluate investing in Opportunity Zones. We can look at your specific scenario to ensure all options are addressed and you receive the maximum tax benefit possible.

Illustrating Opportunity Zone

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.

Leslie Hill, CPA

Tax Senior Manager

Leslie Hill joined Larson Gross in 2008. Today, she’s a Senior Manager in our Agribusiness and Food Processing industry. She has deep expertise in tax preparation and planning for both owner operated and large businesses.