INSIGHTS

INSIGHTS

How manufacturers can manage back-office costs in a tight economy

by RSM US LLP

ARTICLE | April 28, 2023

Filling open positions has been a challenge for manufacturers for years, but a confluence of factors is underscoring this issue in 2023. The labor market remains hot, and virtually every industry is struggling with increased labor costs and filling open roles while simultaneously managing costs amid recession expectations. (RSM US LLP estimates a 75% likelihood of a recession over the next year.)

All these pressures combined are forcing organizations to be highly strategic with their talent. Manufacturers should assess how their information technology and broader technology teams are enabling peak efficiency amid these continued labor hurdles.

The jobs picture

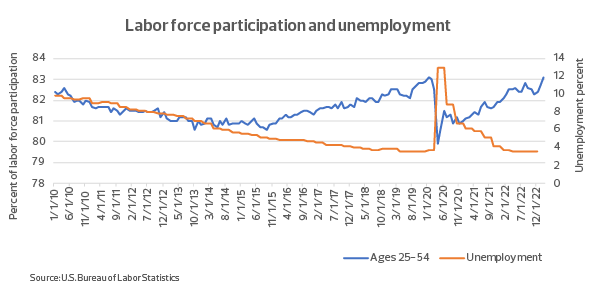

The United States is back at full employment, with the unemployment rate among prime-age workers (25 to 54) at its lowest level in more than 50 years, according to U.S. Bureau of Labor Statistics data.

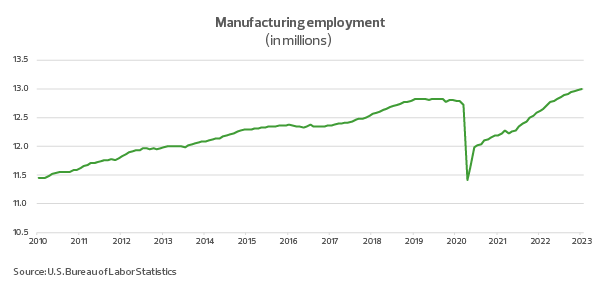

If we zoom in on manufacturing payrolls, the United States currently employs more workers in the industry than it has at any other point in the past 13 years.

"We expect to see more manufacturers lock in long-term agreements with managed services organizations to ensure fixed labor rates and schedules."

Mitchell Gore, industrials senior analyst, RSM US LLP

Still, there are over 11 million open jobs in the United States, and manufacturing accounts for 764,000 of those. It is no secret that for U.S. manufacturers to compete, they need to do more with less. That means investing in technology, and surveys indicate companies are well aware of this need. A Manufacturing Leadership Council Transformative Technologies in Manufacturing survey in the fourth quarter of 2022 found that 89% of manufacturer respondents expect their company’s rate of adoption of disruptive technologies to increase over the next two years. That figure is up from 51% just one year prior.

Several recent surveys from the MLC, RSM, and the Institute of Supply Management also indicate declining optimism among manufacturing executives on the state of the economy. To weather anticipated economic headwinds, companies in the sector need to prioritize technological adoption and ensure the right teams are focused on the highest-value activities related to implementing, deploying, and maintaining technology.

The role of IT

Advanced data analytics, digital twins, increased automation, Internet of Things devices, 5G, and advanced robotics are just some of the technologies manufacturers need to embrace. One inherent challenge in doing so, however, is many of these technologies require specialized knowledge. If you have a small IT team, each of its members needs to focus on specific areas. The days of the IT generalist are well behind us.

The question that ultimately comes to the forefront is, how can middle market manufacturers deploy the required technology to stay competitive, drive top-line growth, and maintain margins when they cannot hire the required talent?

One strategy that can help is to assess all of your technology team’s initiatives and categorize each as an activity that maintains, grows, or transforms the business.

Maintaining the business, while a core need, will require partnerships in the future. We expect businesses to look for alternative ways to staff IT functions with outsourcing or managed services. Good areas for partnership opportunities include IT service desk/help desk; systems management, including cloud platforms and on-premises server administration; and infrastructure maintenance, upgrades, or refreshes. We expect to see more manufacturers lock in long-term agreements with managed services organizations to ensure fixed labor rates and schedules.

Growing the business requires improving and elevating current platforms to drive more value. Internal champions of new systems and upgrades must drive utilization and adoption across the organization. As an example, if a company has a business intelligence platform and dashboards to track various data metrics, the future success in the use of these tools depends on the IT team’s ability to continually assess, develop, and train staff to use and improve those tools as the business evolves.

Another example within IT security—which is evolving faster than most companies can keep up with—also falls into a category that is ripe for ongoing focus. As facilities get more and more connected and data-driven, we see more operational technology interconnecting with IT networks. These activities pose an increased security risk, which may require a specialist or a partner to maintain security between the two networks while allowing additional data metrics to be fed into business systems.

Transforming the business is about ensuring that changes to the organization generate significant value. This is where Industry 4.0 technologies can play a critical role, including new enterprise resource planning software, Internet of Things devices, autonomous technology, and advanced data solutions. Deployment of these systems will require your manufacturing technology team to be intimately involved to understand how to drive the most value during implementation, while third-party partnerships will play a role in deployment and knowledge transfer. From a strategic standpoint, this is where you want to have your internal IT team focus its effort.

Businesses will need to be selective with hiring, making internal resource management decisions, and considering which functions may benefit the most from partnerships. Manufacturers should focus hiring efforts on the talent that creates value and have those employees focus on areas that are unique to their operations while outsourcing necessary but more foundational roles. While hiring and retention will still be hard, and may cost more than planned, they are core to your business and will provide the most value going forward.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Mitchell Gore and originally appeared on Apr 28, 2023.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/manufacturing/how-manufacturers-can-manage-back-office-costs-in-a-tight-economy.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Larson Gross PLLC is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Larson Gross PLLC can assist you, please call (800) 447-0177.