INSIGHTS

INSIGHTS

Finding the Social Security “sweet spot”

by Teresa Durbin, CPA

If you’re like most Americans, Social Security benefits will account for a significant portion of your retirement income. The program is designed to replace a percentage of a worker’s pre-retirement income. The amount you receive in Social Security benefits is determined using a complex calculation, which bases your retirement benefits on your highest 35 years of Social Security earnings, adjusted for inflation. The higher your lifetime Social Security earnings, the higher your Social Security retirement benefits will be.

If you’re a taxpayer who has the ability to adjust your Social Security earnings, you’re in a particularly unique position. You have a lot of flexibility when deciding how much Social Security earnings to pay tax on each year. While there are immediate tax savings to paying in less Social Security tax now, this decision could affect the amount of your long-term Social Security retirement benefits. If your Social Security earnings are too low, you may be missing out on opportunities to maximize your Social Security benefits during retirement. In other words, there is a “sweet spot” where you may be able to get a good long-term return on your investment by purposely paying in more Social Security taxes today.

To help determine the “sweet spot,” it is helpful to know how the Social Security Administration calculates retirement benefits. Here are the three steps:

- The first step in that calculation is to tally up your highest 35 years of Social Security earnings, indexed for inflation. If you don’t have a full 35 years of work, then you’ll have some zero years worked into the calculation, which will lower your benefits. You must have at least 10 years of work to qualify for benefits.

- After the Social Security Administration has picked out your highest 35 years of work, they will calculate your AIME (Average Indexed Monthly Earnings). This is an inflation-adjusted average of your monthly earnings over your highest 35 years.

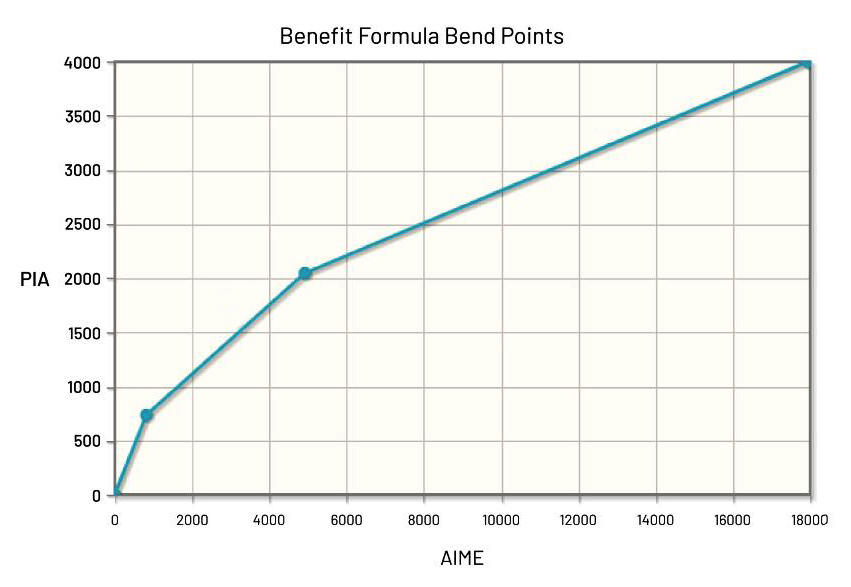

- The final step in the calculation is to multiply your AIME by 3 percentage points. Your Social Security retirement benefit will be the sum of these 3 calculations: 90% of the first $996 of AIME, 32% of your AIME between $997-$6,002, and 15% of your AIME over $6,002, up to the maximum AIME of $10,700. These points are referred to as bend points as you can see in the graph below:

As you may notice in step 3, there is a diminishing return of Social Security benefits for those with higher lifetime Social Security earnings. What you will want to do is compare the trade-off of paying in more payroll taxes with the benefit of increased Social Security retirement benefits.

The “sweet spot” is hit when you have about $5,700 of AIME. This will bring your primary insurance amount (Social Security retirement benefit amount if a person elects to receive it at normal retirement age) to about $2,000, right at the second bend point on the chart above. This is accomplished when an individual earns the indexed equivalent of $70,000 each year for 35 years. Note: this is the indexed equivalent. For example, a $22,600 wage in 1985 is the indexed equivalent of a $70,000 wage today.

If you aren’t sure where your AIME is at, contact us. We can assist you in calculating this for you and let you know if it makes sense to adjust your Social Security earnings between now and retirement, so you can get the best outcome for your Social Security payments.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.