INSIGHTS

INSIGHTS

FAQs about the 2021 Child Tax Credit

by Adrienne Stewart, CPA/ABV

The recently enacted $1.9 trillion American Rescue Plan Act implemented some hefty changes that will have U.S. families receiving some extra cash in 2021. In addition to the stimulus checks delivered to millions of eligible Americans, the American Rescue Plan Act introduces another direct payment to families through the expansion of the Child Tax Credit. We’ve assembled some of your most frequently asked questions and have provided answers below.

1. What were the 2020 child tax credit rules?

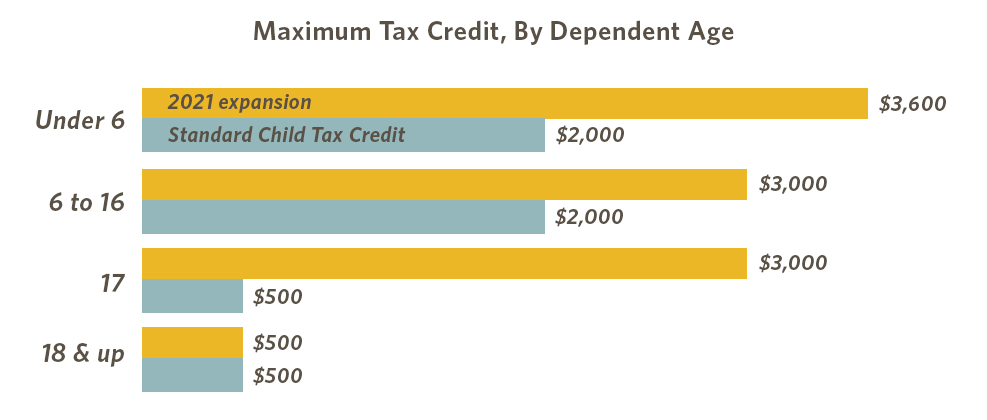

For 2020 tax returns, which are now due May 15, 2021, the child tax credit is worth $2,000 for every child under the age of 17 claimed as a dependent on your return. If your adjusted gross income (AGI) is more than $400,000 on a joint return or more than $200,000 on a single or head-of-household return, your credit amount is reduced. Additionally, you must have at least $2,500 of earned income to get any refund at all.

2. What’s changing for 2021?

Thanks to the American Rescue Plan Act, the credit is massively expanded in the following ways:

- It increases the credit to $3,000 per child ($3,600 per child under the age of 6).

- It allows 17-year-old children to qualify for the credit.

- It makes the credit fully refundable and removes the $2,500 earnings qualification.

- It requires the IRS to pay half of your credit in advance by sending periodic payments from July 2021 to December 2021.

3. Who qualifies for the 2021 credit?

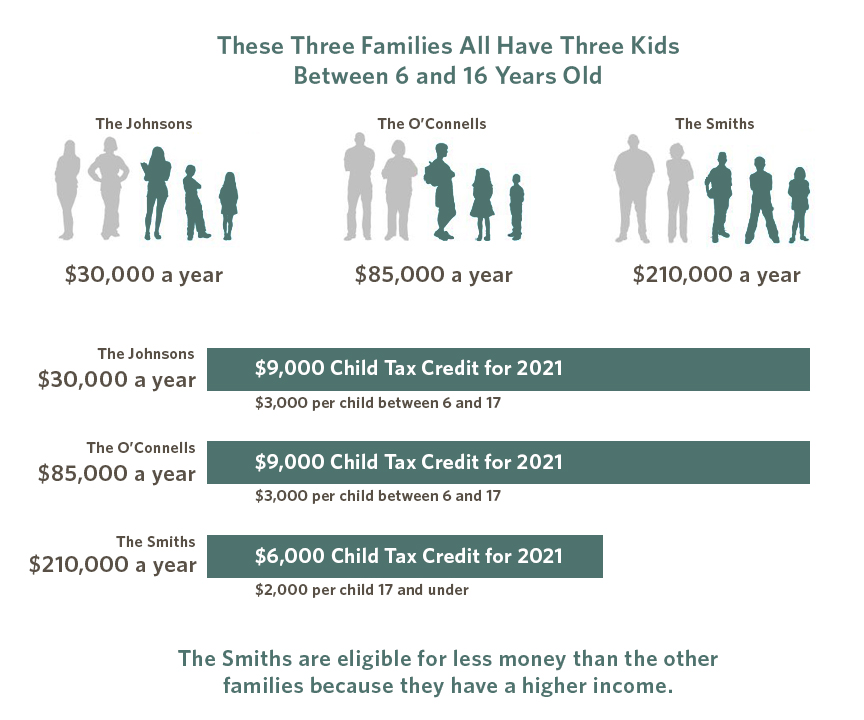

Not every family will be eligible for the 2021 credit increase. The tax break begins to phase out at AGIs of:

- $75,000 on single returns

- $112,500 on head-of-household returns; and

- $150,000 on joint returns.

4. If my income makes me ineligible for the $3,000/$3,600 credit, can I still claim the original $2,000 credit when I file my return?

If your family isn’t eligible for the 2021 increased credit amount, you could claim the regular credit of $2,000 per child if you have AGIs at or below $400,000 on joint returns or $200,000 on other returns. Families with AGIs above these thresholds will receive a reduced credit.

5. Can I take the higher 2021 credit amount for my child that turns 17 in 2021?

Yes. If you meet all the other rules, you can claim the credit for your child when you file your 2021 Form 1040 next year (in 2022). This is one of the expanded perks that the American Rescue Plan Act offers.

6. Is the child tax credit fully refundable in 2021 and what does that mean?

The American Rescue Plan Act made the child credit fully refundable for people living in the U.S. for more than half the year. In simple terms, the money you get from the 2021 child tax credit is money in your pocket that you don’t need to repay in any way.

7. What’s this talk about advanced payments?

Not only does the American Rescue Plan Act expand the child tax credit, but it also creates a tall order for the IRS. The plan requires the IRS to pay half of the tax credit in advance. If the IRS can scramble in time, it will send out payments periodically from July through December.

The IRS will base eligibility for the credit and advance payments based on previously filed tax returns. First, it will look at your 2020 return, and if you have not filed your 2020 return, it will move to your 2019 return.

It's unclear whether the IRS can get this up and running by July and make monthly payments. If it does, then most families will receive six payments in 2021, one each month from July through December. The advance payments in total will account for half of a family’s 2021 child tax credit. The remaining half of a family’s credit will be provided when filing their 2021 tax return.

8. How will I receive the advanced payments?

It appears the IRS will use the same payment method as the stimulus checks – either through a direct deposit account on file with the IRS, a paper check, or a Direct Express card.

9. What if something changes during 2021 and I have more or less income than shown on my 2020 or 2019 return?

The IRS will calculate eligibility and credit amounts based on your previously filed tax returns – first, looking at 2020, and if you have not filed your 2020 return, it will look at your 2019 return. The IRS

assumes that the number of children and income that you reported on these returns are the same for 2021 (even though we know things change and fluctuate in reality). The only instance the IRS accounts for time is when determining the age of your dependents.

However, there is a way you can update your income, marital status and number of children. The American Rescue Plan Act requires the IRS to set up an online portal, so if your circumstances have changed and you want to proactively note them, you can do so at your discretion. This is a voluntary process but may benefit those who could gain additional dollars from the credit by updating their information.

If you have a baby in 2021, you can update the online IRS portal, so you begin receiving advanced payments. If you don’t update the portal to accommodate your new bundle of joy, not all is lost. You’ll still be able to report your new child on your 2021 tax return next year and receive the child credit (you just won’t get the advance payment amount for him/her).

10. Do I have to pay tax on the payments I receive?

No. The advance payments you receive for the 2021 child tax credit are not taxable. The IRS is required to mail you a notice by January 31, 2022 that shows the total amount of payments made to you in 2021 and this amount is not taxable.

11. If the IRS overpays me for the child credit, do I have to pay them back?

An advance payment process is bound to have a few hiccups, including paying families more than they are entitled to. So, what happens when you got too much cash?

If your family has an AGI of at least $80,000 on a single return, $100,000 on a head-of-household return or $120,000 on a joint return, you’ll need to repay any money you were overpaid by the IRS when you file your 2021 tax return next year.

12. Can I opt out of the advance payments?

Yes, you can opt out of advance payments and instead take the full child credit on your 2021 return. This will be an available option through the IRS portal.

13. Will the higher child tax credit amounts and advance payments be made permanent?

We don’t know…yet. Some Democratic lawmakers would the expansions to be made permanent as they have already introduced bills in the House and Senate to do so. However, it’s too soon to tell if these changes will be made permanent for years to come. For now, the child tax credit expansions

apply only for 2021.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.