INSIGHTS

INSIGHTS

Common Misconceptions About Personal Income Tax Returns

by Britta Roper, CPA

Not necessarily. If you receive a refund, it means that the combination of federal taxes withheld on your paychecks, estimated tax payments, and tax credits would have exceeded the final amount of tax you were responsible for paying. Some would argue that a perfect tax return would result in a $0 refund. If you overpay taxes, and the IRS holds your funds, then you are not earning any interest on those funds. Alternatively, you could lower your tax withholding and invest those funds elsewhere.

Misconception #2: Your income is taxed at one flat rate.

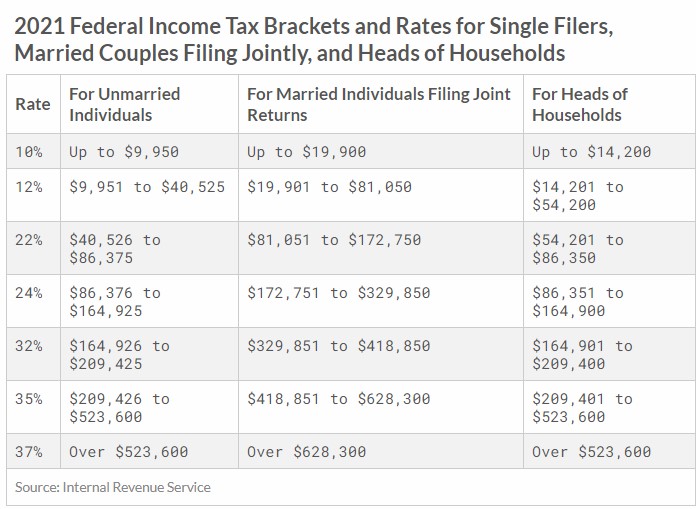

This is only true if you are in the 10% tax bracket. Most taxpayers are in a higher bracket. Let’s take an unmarried taxpayer who has $165,000 of taxable income in 2021 as an example. You’ll notice in the chart below that this individual would fall under the 32% tax rate row. This is not the rate that all of his/her income will be taxed at. Of the $165,000 of taxable income, in reality:

- $9,950 is taxed at 10%

- $30,574 is taxed at 12% --- ($40,525 - $9,951)

- $45,849 is taxed at 22% --- ($86,375 - $40,526)

- $78,549 is taxed at 24% --- ($164,925 - $86,376)

- Just $74 is taxed at 32% --- ($165,000 –$164,926)

In the end, this person will owe $33,627 in federal tax. This final amount comes from $165,000 of income taxed not at one flat rate, but at five rates ranging from 10% to 32%, with an overall average tax rate of 20.3%.

Misconception #3: Unemployment earnings are not taxable.

Unemployment earnings are taxable on your federal tax return and potentially on your state tax return if you live outside of Washington State. This may be surprising to some since the benefit payments are provided during a time of financial loss. Having to pay taxes on unemployment benefits may feel like an additional financial burden all on its own. However, these benefits will indeed be taxable income and the tax consequences should be planned for.

When applying for unemployment benefits, there will be an option to withhold 10% of the benefit payments to help cover your taxes. This is a smart option if you have enough cash in the short term and do not want an unfavorable tax surprise when filing your tax return.

Misconception #4: If I make a charitable contribution, it’s deductible on my tax return.

Not always. It's not uncommon for a charitable organization to advertise that donations to their charity are tax-deductible. From there, it can be easy to assume that all charitable contributions are going to be beneficial in lowering your tax liability. This may be true for some taxpayers, but this is not the case for many.

Whether or not a taxpayer gets a tax benefit from charitable contributions depends on whether they will take the standard deduction on their tax return or itemize. Charitable contributions will only be deductible if the taxpayer itemizes. Taxpayers should consult with their tax advisor to determine if charitable contributions will impact their tax liability.

If you have questions about personal income tax or would like to explore our tax services, please contact us.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.