INSIGHTS

INSIGHTS

Navigating 2026 Tax Changes: Key Inflation Adjustments and Why They Matter

by Teresa Durbin, CPA, Larson Gross

ARTICLE | October 27, 2025

Every year, inflation reshapes the tax landscape, adjusting deductions, credits, and thresholds that directly affect both individuals and businesses. For the 2026 tax year, these inflation-driven updates — coupled with provisions under the One, Big, Beautiful Bill Act (OBBBA) — introduce several opportunities for proactive tax planning. At Larson Gross, we believe understanding these nuances early can help clients optimize their financial strategies and avoid last-minute surprises. Standard Deduction Increases: Simplifying Filing Decisions

- The standard deduction has once again risen:

- Married filing jointly: $32,200 (up from $31,500)

- Single / Married filing separately: $16,100 (up from $15,750)

- Head of household: $24,150 (up from $23,625)

These adjustments might seem modest, but they can shift the balance between itemizing deductions versus taking the standard deduction. For many taxpayers, this simplifies filing while potentially reducing taxable income.

Do you regularly donate to charity but not enough to itemize each year? Consider bunching your donations by giving a larger amount every other year or establishing a donor advised fund.

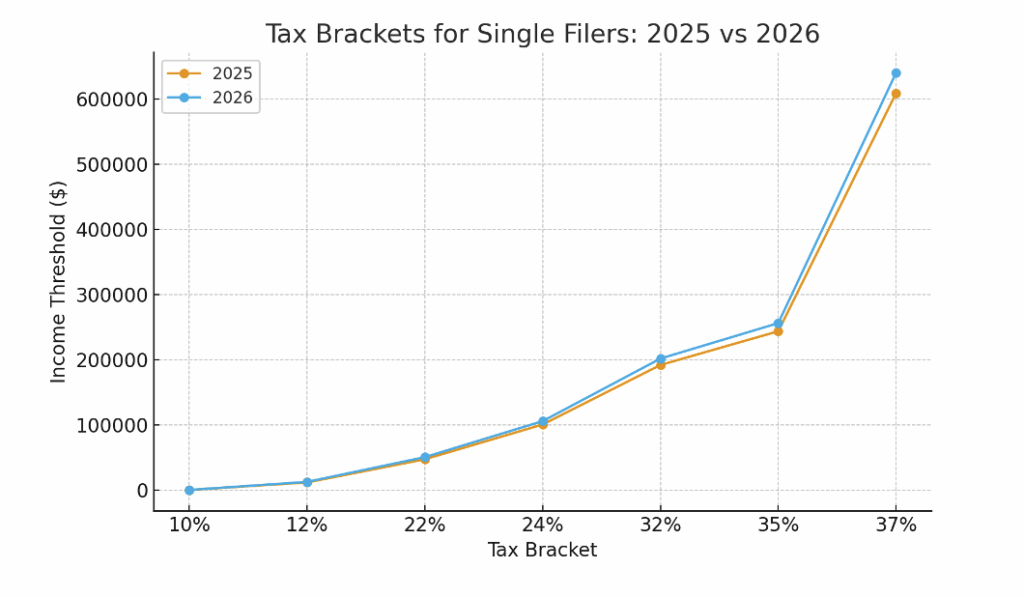

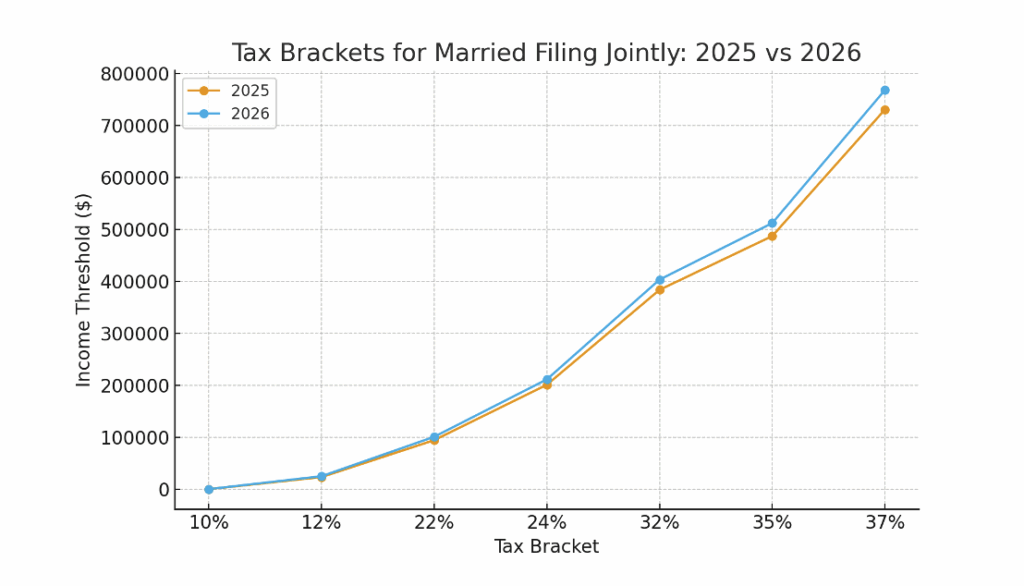

Marginal Tax Rate Threshholds: Planning Around Bracket Shifts

While the top rate remains at 37%, income thresholds have moved higher, effectively giving many taxpayers a small “raise” through bracket creep relief. The OBBBA made permanent the lower individual tax brackets established by the Tax Cuts and Jobs Act (TCJA).

| Tax Rate | Single | Married Filing Jointly |

| 37% | Over $640,600 | Over $768,700 |

| 35% | $256,225 – $640,600 | $512,450 – $768,700 |

| 32% | $201,775 – $256,225 | $403,550 – $512,450 |

| 24% | $105,700 – $201,775 | $211,400 – $403,550 |

| 22% | $50,400 – $105,700 | $100,800 – $211,400 |

| 12% | $12,400 – $50,400 | $24,800 – $100,800 |

| 10% | Up to $12,400 | Up to $24,800 |

|

|

Why this matters:

Bracket shifts can subtly reduce your effective tax rate. Strategic timing of income, deductions, or investment gains — particularly near bracket thresholds — can yield meaningful savings. Planning helps ensure these decisions are coordinated with your broader financial goals.

Alternative Minimum Tax (AMT): Higher Exemptions, Lower Exposure

For 2026, the AMT exemption rises to:

- $90,100 for individuals (phasing out at $500,000)

- $140,200 for joint filers (phasing out at $1,000,000)

Why this matters:

The higher exemptions mean fewer taxpayers will be caught by the AMT. However, those with incentive stock options or significant deductions should still assess exposure through a midyear tax projection.

Adoption Credits: More Support for Growing Families

The maximum credit increases to $17,670, with up to $5,120 refundable.

Why this matters:

The refundable portion can provide relief to families who may not owe enough taxes to otherwise benefit. Timing the adoption finalization to align with the new limits could maximize your credit.

Employer-Provided Childcare Credit: Big Boost for Businesses

Under the OBBBA, the credit cap for employer-provided childcare jumps from $150,000 to $500,000, and up to $600,000 for small businesses.

Why this matters:

This expansion encourages employers to invest in family-friendly benefits — enhancing talent retention while generating meaningful tax relief. Larson Gross can help model the ROI of offering such benefits.

Permanent Expansion and Indexing of Child Tax Credit: Greater Relief for Working Families

The OBBBA increased and made permanent the child tax credit (CTC). The bill bumped the maximum credit up to $2,200 for 2025 and 2026 (previously $2,000 per qualifying child under age 17) with up to $1,700 refundable. Moving forward, the credit will be adjusted for inflation.

Why this matters:

Parents and guardians across the U.S. rely on the CTC to help offset the cost of raising children. The program provides financial relief to American taxpayers with dependent children and has lifted millions of children out of poverty. This credit impacts household cash flow — especially when coordinated with dependent care credits. Without the OBBBA, the maximum credit would have reverted to $1,000 in 2026.

Health & Medical Accounts: Incremental But Impactful Adjustments

- FSA limit: $3,400 (carryover up to $680)

- HSA limit: $4,400 (self-only); $8,750 (family)

- MSA deductibles: $2,900–$4,400 (self-only); $5,850–$8,750 (family)

- MSA out-of-pocket maximums: up to $5,850 (self-only); $10,700 (family)

Why this matters:

These small increases allow more pre-tax healthcare spending. Careful contribution planning for FSA accounts prevents forfeiting unused funds.

Foreign Earned income Exclusions (FEIF): Relief for U.S. Expats

The FEIE increases to $132,900, up from $130,000.

Why this matters:

For globally mobile professionals, this adjustment slightly reduces U.S. taxable income. Still, documentation of residence or physical presence is critical for compliance.

Annual Gift Exclusion: Stable for Most, Updated fro International Couples

- General exclusion: $19,000 (unchanged)

- Gifts to non-U.S. citizen spouses: $194,000

Why this matters:

Cross-border couples should revisit estate and gift strategies to maximize tax efficiency and compliance with international thresholds.

Final Thoughts: Small Adjustments, Big Oppurtunities

While inflation adjustments may appear incremental, their cumulative effect can meaningfully impact financial outcomes. Whether you’re optimizing deductions, reviewing estate plans, or leveraging new credits, timing and coordination are key.

At Larson Gross, our advisory team helps clients interpret these updates through the lens of long-term strategy — ensuring each change becomes an opportunity for tax efficiency, business growth, or legacy preservation.

Let’s plan ahead, not react later.

Contact your Larson Gross advisor to review how these 2026 updates fit into your tax and financial plan.

Larson Gross is here to walk you through these changes and help you make the most of them for your operation. Please contact us to learn more at 800-447-0177.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.

Teresa Durbin, CPA

Tax Senior Manager, Larson Gross Advisors

Teresa Durbin joined Larson Gross back in 2009, and she proudly brings over a decade of experience in public accounting to her role. She specializes in offering comprehensive federal and state tax consulting services to closely held businesses and high net worth individuals. What truly fuels her passion is the opportunity to work with clients across a wide spectrum of industries.