INSIGHTS

INSIGHTS

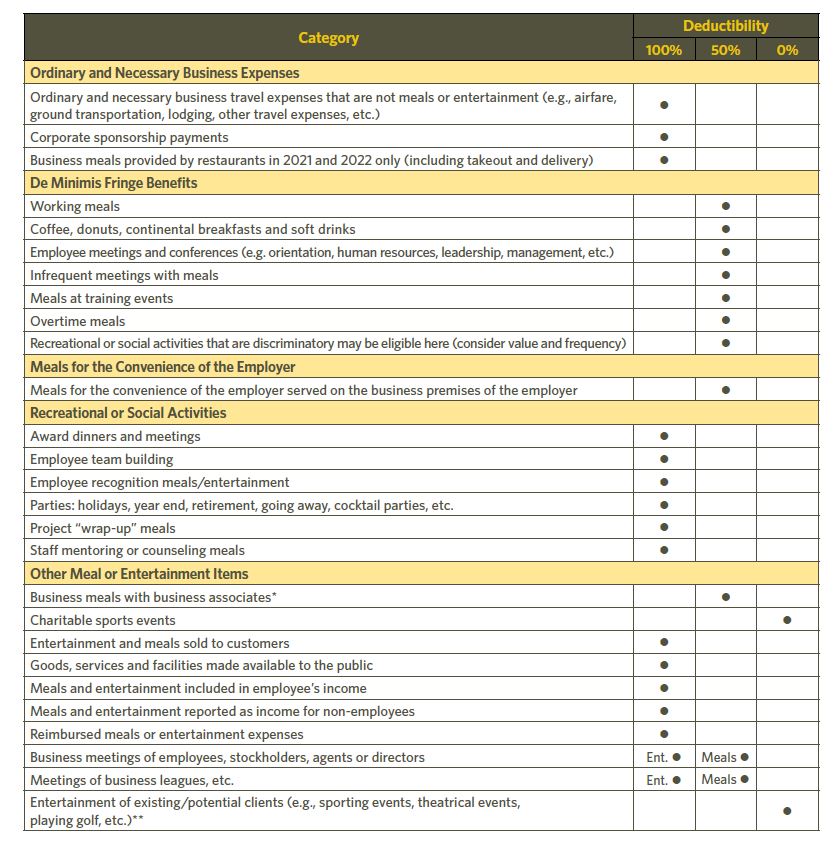

2021 Meals and Entertainment Deduction Guide

On December 27, 2020 President Trump signed into law the Consolidated Appropriations Act, 2021 (the CAA). This new law removes the 50% limit on deducting business meals provided by restaurants in 2021 and 2022 and makes those meals fully deductible, as an incentive to help the restaurant industry that has been negatively impacted by the COVID-19 pandemic. Learn more about all Meal and Entertainment deductions below.

The Consolidated Appropriations Act of 2021 included a provision that removes the 50% limit on deducting business meals provided by restaurants in 2021 and 2022 and makes those meals fully deductible.

The use of the word “by” a restaurant makes it clear that the new rule isn’t limited to meals eaten on the restaurant’s premises. Takeout and delivery meals provided by a restaurant are also fully deductible.

Other than lifting the 50% limit for restaurant meals, the legislation doesn’t change the rules for deducting business meals. All the other existing requirements continue to apply:

- The food and beverages can’t be lavish or extravagant under the circumstances.

- An owner or employee must be present when the food or beverages are served.

- The food or beverages must be provided to you or to a “business associate.” This is defined as a current or prospective customer, client, supplier, employee, agent, partner, or professional adviser with whom you could reasonably expect to engage or deal in your business.

Business Gifts

The tax rules limit the deduction for business gifts to $25 per person per year, a limitation that has remained the same since it was added into law back in 1962.

- The $25 limit applies only to gifts directly or indirectly given to an individual.

- If you have a business connection with both spouses and the gift is for both of them, the $25 limit doubles to $50.

- Gifts given to a company for use in the business aren’t subject to the limit.

- For example, a gift of a $200 reference manual to a company for its employees to use while doing their jobs would be fully deductible because it’s used in the company’s business.

Gifts to Employees

De Minimis Benefits

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical. These include:

- Occasional employee use of photocopier.

- Occasional snacks, coffee, doughnuts, etc.

- Occasional tickets for entertainment events.

- Holiday gifts.

- Occasional meal money or transportation expense for working overtime.

- Group-term life insurance for employee spouse/dependent with face value less than $2,000.

- Flowers, fruit, books, etc.

- Personal use of a cell phone provided by an employer primarily for business purposes.

The IRS has ruled that items with a value more than $100 aren’t considered de minimis.

Cash Benefits Cash is generally intended as a wage, and usually provides no administrative burden to account for. Thus, cash is not a de minimis fringe benefit.

Gift Certificates Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. A certificate that allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for, may be excludable as a de minimis benefit, depending on facts and circumstances.

Achievement Awards Special rules apply to allow certain employee achievement awards to be excluded from wages. These awards can’t be cash, cash equivalent, vacation, meals, lodging, theater or sports tickets, or securities.

The maximum amount of excludable awards to a single employee during a calendar year is limited to $400 for awards made under a nonqualified plan; or $1600 in total for awards made under both qualified and nonqualified plans.

Let's Talk!

Call us at (360) 734-4280 or fill out the form below and we'll contact you to discuss your specific situation.