INSIGHTS

INSIGHTS

§179D Tax Deduction for Energy-Efficient Projects

by Meaghan E. Greydanus, CPA, Partner

ARTICLE | February 18th, 2025

Commercial building owners and designers of public building projects that incorporate certain sustainable building components can qualify for the Energy Policy Act (EPAct) §179D tax deduction.

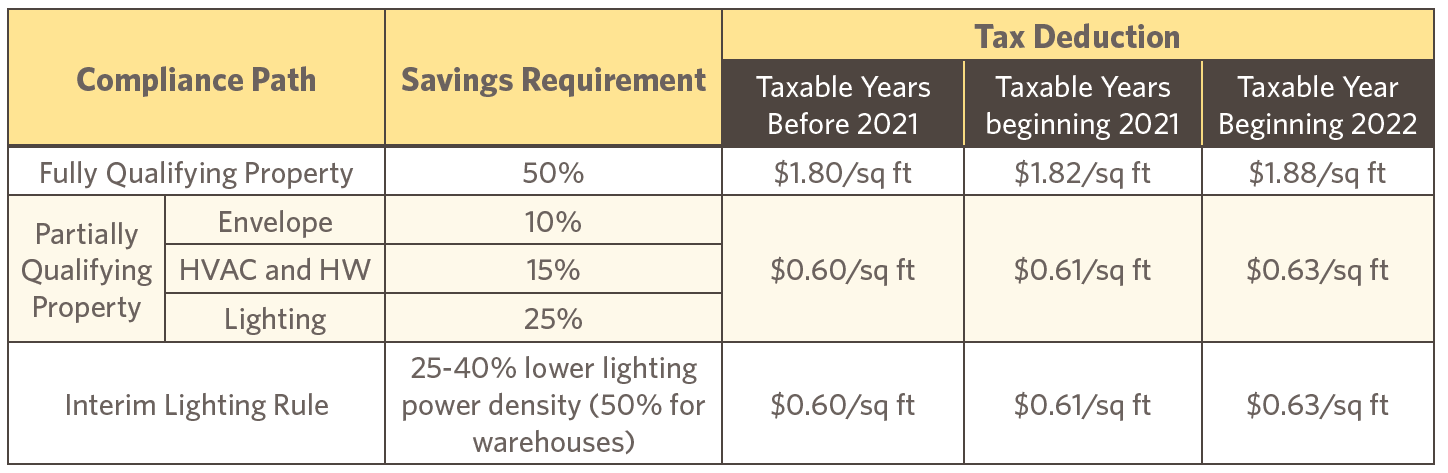

The §179D deduction allows for up to $1.80 per square foot for taxpayers (or the designer if the building is government owned) that improve the efficiency of their commercial and residential rental buildings that are four stories high or more, above certain other thresholds.

The §179D deduction is a permanent part of the tax code and doesn’t expire.

Summary of §179D Tax Deduction

Note: for tax years beginning in 2023, the following summary has been impacted. See section on Changes to the §179D deduction.

Which Buildings Qualify for the §179D deduction?

- Must be placed in service after December 31, 2005

- Must be in located the United States

- Installation made is part of interior lighting systems, HVAC and hot water systems and the building envelope

- Energy and power consumption calculations are based on IRS-approved software programs that compare the subject facility to an ASHRAW reference building

- Must be certified by an IRS-qualified professional engineer or contractor licensed in the same jurisdiction as the proposed building

- In addition, the IRS provides Interim Lighting Rules as an alternative method of evaluation. These rules allow a watts-persquare- foot calculation or a lighting-power-density calculation to be used in lieu of modeling when measuring energy efficiency.

Eligible improvements include the following:

- Building Envelope

- Heating, cooling, ventilation, and hot water systems (HVAC)

- Interior lighting systems

Who can claim the §179D deduction?

- Owners and tenants of commercial buildings who have built or installed improvements

- Owners of four-story or greater residential buildings who have built or installed improvements

- Designers of government-owned buildings (architects, engineers, or contractors)

Changes to the §179D deduction

On August 16, 2022, the Inflation Reduction Act was signed into law. Included in this bill are changes to the existing §179D deduction.

For tax years starting in 2023, the following changes have been made to the existing §179D deduction.

- The partial deduction, including the interim lighting rule, is eliminated.

- The energy savings target is reduced from 50% to 25% and the amount of the deduction is reduced from $1.88 per square foot to $0.50 per square foot. For each percentage point increase in energy savings, the deduction goes up by $0.02 to a maximum of $1.00 per square foot for a reduction of 50%.

- If the building owner or designer meets the prevailing wage requirement and an apprenticeship requirement, the deduction increases to a $2.50 per square foot with 25% energy savings. The deduction increases by $0.10 per square foot for every percentage increase until it reaches $5.00 per square foot with 50% energy savings.

– Prevailing wage requirements generally require “Davis Beacon Act” wages.

– The new apprenticeship requirement is based on the new Section 45(b)(8), which requires that a certain percentage of labor hours be performed by a qualified apprentice in a registered apprenticeship program.

- Currently, the deduction must be reduced by all past §179D deductions (per building). The Act reduces this to a three-year lookback period for property owners, and four years for building designers.

For more information on the §179D tax deduction and how we can help, please call us today at (360) 734-4280.