INSIGHTS

INSIGHTS

Starting a Business in the United States

ARTICLE | February 19th, 2025

Starting a new business in the US doesn’t have to be confusing or overwhelming if you follow a few steps. The following information provides an overview of the actions you’ll need to take to get your new venture off the ground.

Many of the decisions you make in launching your business can have a lasting impact on how your business operates and is taxed. Laying a strong foundation is key to preparing your business for future success.

Step 1: Pick Your Business Location

Choosing a business location involves considering factors such as the target market, business partners, personal preferences, and costs, benefits, and restrictions imposed by different government agencies.

By making a well-informed decision about your business location, considering factors such as taxes, zoning laws, and regulations, you can position your venture strategical- ly and set a solid foundation for its success.

Location

The location you opt for will determine the tax obliga- tions imposed on your business. Different regions have varying tax structures, including income taxes, sales taxes, property taxes, and business-specific taxes. Conducting thorough research on the tax rates and incentives offered by different jurisdictions is crucial to understanding the financial implications of your location choice.

Region-Specific Expenses

Startup costs can vary depending on the location, includ- ing expenses such as salaries, minimum wage laws, prop- erty values, rental rates, business insurance rates, utilities, and government licenses and fees.

Zoning Ordinances

Zoning laws and regulations also play a vital role in determining where your business can operate. Zoning ordinances divide areas into specific zones, such as resi- dential, commercial, or industrial, and regulate the types of businesses permitted in each zone. It is important to ensure that your chosen location aligns with the zoning requirements for your business activities. Consult with local authorities or city planning departments to confirm compliance.

Regulations & Licensing

Regulations and licensing requirements can vary between jurisdictions. Certain cities or states may have specific regulations or licensing procedures that impact your business operations. Understanding and adhering to these requirements is essential for legal compliance and the smooth functioning of your business.

State & Local Taxes

The tax landscape, including income tax, sales tax, prop- erty tax, and corporate taxes, can vary significantly from one state, county, or city to another. Some areas offer tax environments favorable to certain types of businesses.

Incentives

State & Local Incentives

Governments at the state and local levels may provide special tax credits, loans, or other financial incentives to support small businesses. These incentives often focus on job creation, energy efficiency, urban redevelopment, and technology.

Federal Incentives

Small businesses that contract with the federal govern- ment and are located in underutilized areas can benefit from programs like the Historically Underutilized Business Zones (HUBZone), which provides preferential access to federal procurement opportunities.

Step 2: Determine Your Entity Type

There are eight main business entity types from which to choose. Which one you select determines how your busi- ness will be taxed, how it will be managed, and what level of liability you will have as the owner. Some businesses start as one type and change their type as they grow and expand.

Sole Proprietorship

One individual or married couple in business alone. This type of business is simple to form and operate.

► Liability: Sole proprietor has unlimited liability.

► Management: Sole proprietor has full control of management and operations.

► Federal Tax: Not a taxable entity. Sole proprietor pays all taxes on individual return.

Limited Liability Company (LLC)

Formed by one or more individuals or entities through a written agreement. The agreement details the organiza- tion of the LLC, provisions for management, assignability of interest and distribution of profits/losses.

► Liability: Members are not typically liable for the debts of the LLC.

► Management: Members have an operating agreement that outlines management.

► Federal Tax: Not a taxable entity. Income/loss is passed through to members.

General Partnership

Two or more persons who agree to contribute money, labor and/or skill to a business. Each partner shares the profits, losses and management.

► Liability: Partners have unlimited liability.

► Management: Typically, each partner has an equal voice unless otherwise arranged.

► Federal Tax: Not a taxable entity. Each partner pays tax on his/her share of income.

Limited Liability Partnership (LLP)

Similar to a General Partnership except that normally a partner doesn’t have personal liability for the negligence of another.

► Liability: Partners are not typically liable for the debt of the LLP.

► Management: All partners have the right to manage the business directly.

► Federal Tax: Files taxes as separate entity; must meet certain criteria to avoid being taxed as a corporation.

Limited Partnership (LP)

Composed of one or more general partners and one or more limited partners. The general partners manage the business and share fully in its profits and losses. Limited partners share in the profits of the business, but their loss- es are limited to the extent of their investment. Limited partners usually aren’t involved in day-to-day operations.

► Liability: At least one general partner has unlimited liability.

► Management: Limited partners are excluded from management unless they serve on the board of directors.

► Federal Tax: Files taxes as separate entity, must meet certain criteria to avoid being taxed as a corporation.

S Corporation

A legal entity with certain rights, privileges and liabilities beyond those of an individual.

► Liability: Shareholders are not typically responsible for the debts of the corporation.

► Management: Managed by the directors, who are elected by shareholders.

► Federal Tax: Not taxed at the entity level. Income is passed through to shareholders, who claim it on their personal tax returns.

Corporation

A legal entity with certain rights, privileges and liabilities beyond those of an individual.

► Liability: Shareholders are not typically responsible for the debts of the corporation.

► Management: Managed by the directors, who are elected by shareholders.

► Federal Tax: Taxed at the entity level. (Dividends distributed are taxed at the individual shareholder level).

Nonprofit Corporation

If you are considering starting a nonprofit corporation, we encourage you to have a conversation with us first to determine if your idea falls within the requirements for nonprofit organizations as outlined by the State and IRS.

Step 3: Choose Your Business Name

There are a number of factors you should consider as you choose a name for your business.

► Is it easy to remember, spell and pronounce?

► Does it describe your service or product so your targeted buyer will understand what you’re offering?

► Is it too similar to another business so confusion will ensue?

► Has it already been registered by someone else?

► Is it available as a domain name for your website?

There are numerous resources that include tips and tech- niques on naming your business. A quick Google search on “how to name a business” results in a variety of useful sites. Most states have an official Secretary of State website, which provides an online tool to check the availability of entity names. A simple Google search using “[State Name] Secretary of State” will direct you to that state’s website.

Step 4: Register Your Business

The process of registering a business depends on its location and structure. Determining these factors is crucial before proceeding with registration, which typically involves registering the business name with state and local authorities. However, registration may not be necessary if the business operates under the owner’s legal name.

It’s important to note that choosing not to register the business may result in the loss of personal liability protection, legal benefits, and tax advantages.

Should you need to register your business, consult the US Small Business Administration’s Register Your Business page to determine the steps you need to take to register your business at the location you chose.

Step 5: Get Your Tax ID Numbers

State tax ID and federal tax ID numbers are essential for small businesses, as they enable them to fulfill their state and federal tax obligations.

Federal Tax ID Number

An Employer Identification Number (EIN) serves as your federal tax ID and is necessary for various business activities. You require an EIN to fulfill federal tax obligations, hire employees, open a bank account, and apply for business licenses and permits. Applying for an EIN is free and should be done soon after registering your business.

Your business needs a federal tax ID number if it meets any of the following criteria:

► Pays employees.

► Operates as a corporation or partnership.

► Files tax returns for employment, excise, or specific industries such as alcohol, tobacco, and firearms.

► Withholds taxes on non-wages paid to non-resident aliens.

► Utilizes a Keogh Plan, which is a tax-deferred pension plan.

► Collaborates with certain types of organizations.

To apply for an EIN, you can use the IRS assistance tool, which will guide you through a series of questions and collect information such as your name, Social Security Number (SSN) or Individual

Taxpayer Identification Num- ber (ITIN), address, and “doing business as” (DBA) name. Upon verification, you will receive a nine-digit federal tax ID immediately.

State Tax ID Number

The requirement for a state tax ID number depends on whether your business is liable to pay state taxes. In some cases, state tax ID numbers can be used for additional purposes, such as providing

identity theft protection for sole proprietors.

Tax obligations vary at the state and local levels, so it is important to consult your state’s official websites for accurate information.

To determine if you need a state tax ID, you should re- search and familiarize yourself with your state’s regulations regarding income taxes and employment taxes, which are the most common forms of state taxes for small businesses.

The process of obtaining a state tax ID number is similar to obtaining a federal tax ID number, but the specific steps can vary by state. You will need to contact your state government or visit their website to find out the exact procedure to follow.

Step 6: Get Licenses and Permits

For most small businesses, obtaining a combination of licenses and permits from both federal and state agencies is typically necessary. The specific requirements and associated fees for these licenses and permits can vary depending on factors such as the nature of your business activities, location, and the regulations set forth by the government.

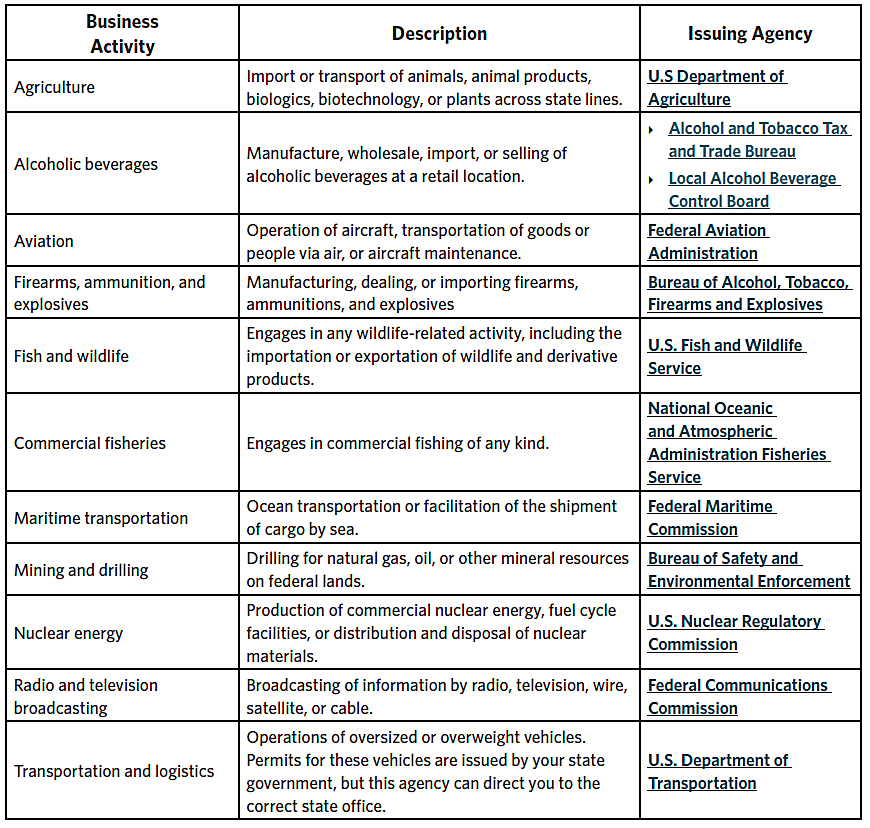

Federal Licenses and Permits

If your business activities are regulated by a federal agency, you’ll need a federal license or permit. Requirements and fees are dependent on your business activities and the agency regulating those activities. Check with the issuing agency to find out more.

To find out if your business activities are regulated by a federal agency, review the Federal

Agencies Regulating Business Activities table on the last page of this handout.

State Licenses and Permits

States typically regulate a wide range of activities, often more than the federal government. Local regulations may cover specific activities such as auctions, construction, dry cleaning, farming, plumbing, restaurants, retail, and vending machines.

It’s important to note that some licenses and permits have expiration dates, and it’s crucial to keep track of when they need to be renewed. Renewing a license or permit is generally easier than applying for a new one.

To determine the specific licenses and permits required for your business, you will need to research the regulations of your state, county, and city. Each state may have different requirements, and it’s important to consult your state’s of- ficial website to find information on the necessary permits and licenses for your specific business activities.

Step 7: Determine Record Keeping Method

Once you’ve registered your business and you’re ready to begin serving customers, you need to be prepared to make and receive payments. That means setting up an appro- priate record keeping system and determining if you will operate on a “cash” or “accrual” basis.

Setting up your bookkeeping system correctly from the beginning can save you considerable time and potential headaches as your business continues to grow. We can assist you with a variety of methods, including QuickBooks.

Step 8: Plan to Pay County Taxes

Some states require that you file a personal property listing for all tangible personal property used in your busi- ness, even if you are a sole proprietor working from your home. This includes things like computers and software, office equipment and furniture, machinery, tools and signs, as well as materials and supplies like office, shop, janitorial and promotional materials. Each county operates slightly differently, so you should check with the Assessor in the county in which your business.

Step 9: Plan to Pay Your State Taxes

A majority businesses are subject to one or more of the following major taxes that are administered by states’ Departments of Revenue.

WA Business and Occupation (B&O) Tax applies to anyone engaged in business activities in the state of Washington.Transactions subject to the retailing B&O tax generally also are subject to the Retail Sales Tax. A business must collect sales tax on the selling price of an item unless it receives a reseller permit or other exemption certificate from the buyer. Sales tax you collect is remitted to the State on a schedule established by the Department of Revenue based on your activity level. Exemptions apply to real estate sales and rentals, farming, and fruit and vegetable processors.

Visit your state’s Department of Revenue for more information and specific rules for your business.

Use Tax should be reported when your business purchases, leases or uses a taxable item without paying sales tax. Articles purchased for use in Washington are subject to either Sales or Use tax but never both.

Step 10: Plan to Pay Taxes in Other States

Your Business may be subject to taxes in other states. Determining if you have “nexus” is the key to preventing costly mistakes in tax reporting. We can help you determine if you have attained nexus in other states and, if so, what and how to file proper tax returns. Give us a call if you have questions about doing business in other states.

Step 11: Grow Your Business

Many start-up businesses aren’t ready to hire employees right out of the gate. To grow, they often rely on indepen- dent contractors to assist them. However, it’s important to understand the differences in how you manage indepen- dent contractors vs. employees. We recommend reviewing our “Is Your Employee Really a Contractor” informational piece.

When you’re ready to take the next step by adding staff, please review our Hiring Employees informational piece.

Step 12: Seek Out Additional Resources

There are a number of online resources that can assist you in starting or developing your business:

U.S. Small Business Administration

This website walks you through the steps for starting your business in the U.S.

The information provided in this document is not intended nor can it be used to avoid tax penalties levied by a taxing au- thority. Actions based on this information should not be taken without further consultation with a licensed tax professional.

If you have any questions, please feel free to reach out to us at 800.447.0177.

Federal Agencies Regulating Business Activities